Thai investors get $1.3B dividends from Vietnamese companies

Billionaire Charoen Sirivadhanabhakdi, the third richest man in Thailand, and other Thai investors have received VND33 trillion (US$1.2 billion) in cash dividends from major Vietnamese companies since 2012.

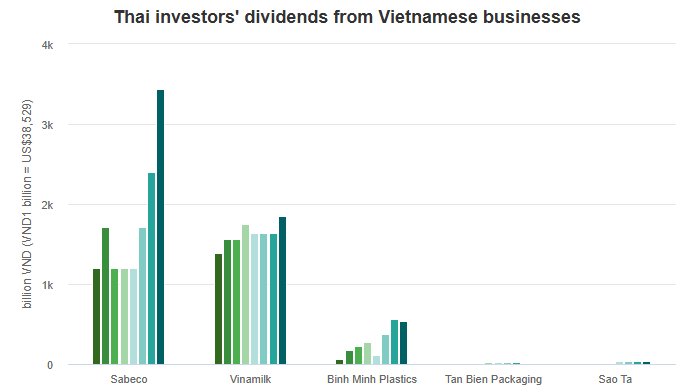

Data compiled by VnExpress shows Thai investors have benefited from the performance of dairy producer Vinamilk, brewer Sabeco, Binh Minh Plastics, packaging firm Tan Bien, and shrimp producer Sao Ta.

Vinamilk, the company with the biggest dairy market share, has paid Thai shareholders VND16.1 trillion since 2013.

Subsidiaries of beverage conglomerate Fraser & Neave own a 20.4% stake in Vinamilk.

Sirivadhanabhakdi’s TCC Holdings acquired Singapore-based Fraser & Neave in 2013.

Last year Vinamilk paid VND1.85 trillion in dividends to Fraser & Neave. The company has repeatedly tried to buy tens of millions more of Vinamilk shares on the stock market in recent years, but failed due to unfavorable market conditions.

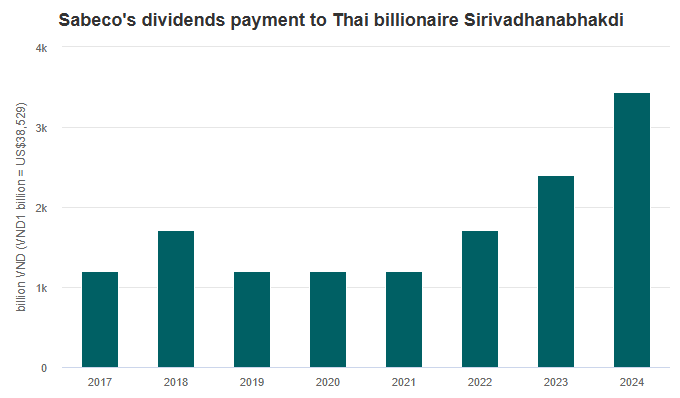

Sirivadhanabhakdi also holds a controlling interest in Sabeco. In 2017, ThaiBev, a company under Sirivadhanabhakdi’s ownership, invested $4.8 billion to acquire 53.6% of Sabeco’s capital from Vietnam’s Ministry of Industry and Trade.

Over eight years, ThaiBev has collected more than VND14 trillion in dividends from one of Vietnam’s leading beer producers. In 2024, the Thai company received its largest payout to date, totaling VND3.44 trillion.

At a press conference in Thailand in September 2022, Thapana Sirivadhanabhakdi, CEO of ThaiBev, described Sabeco as a “crown jewel,” a rare asset among regional beer producers.

ThaiBev’s investment in Sabeco reflects a long-term strategy to dominate Vietnam’s beer market and establish a foothold for expansion across Southeast Asia.

Beyond Vinamilk and Sabeco, Sirivadhanabhakdi, through TCC Holdings, acquired Vietnam’s Metro supermarket chain for $704 million, later rebranding it as Mega Market.

The most profitable Thai investment in Vietnam has been the acquisition of Binh Minh Plastics.

Nawaplastic, a subsidiary of Thailand’s SCG Group, gained control of Binh Minh Plastics in 2018 by buying 24.2 million shares from the State Capital Investment Corporation.

An SCG subsidiary had already become a shareholder of this leading plastics company in 2012. Nawaplastic is estimated to have spent around VND2.75 trillion to acquire the stake. Since 2012 it has received over VND2.5 trillion in dividends.

The shares held by SCG’s subsidiary have a current market value of about VND7.2 trillion, three times the initial investment.

SCG, a conglomerate with interests in cement, construction materials, packaging, and petrochemicals, controls several other Vietnamese companies like Tan Bien Packaging, Tin Thanh Packaging and Duy Tan Plastics.

It is also the behind a petrochemical complex in Ba Ria – Vung Tau Province in southern Vietnam. The facility, which cost more than $5 billion, has an annual capacity of 1.4 million tons of products. Thai investors are also exploring opportunities in industries like finance and retail.

The Siam Commercial Bank Public Company, Thailand’s fourth largest bank, owns Home Credit Vietnam, while Krungsri acquired SHBFinance from lender SHB.

In retail, Thailand’s Central Retail Group owns brands such as GO! (formerly Big C) and Nguyen Kim. “Thailand is a major contributor to Vietnam’s FDI story,” Ahmed Yeganeh, country head of corporate banking services at HSBC Vietnam, said.

A 2024 HSBC survey found 66% of Thai businesses expressing interest in investing in Vietnam. Thailand ranks among the top three countries in terms of confidence in business development in Vietnam with a 93% rate and behind only Vietnam itself (98%) and Singapore (94%).

Data from the Foreign Investment Agency shows that Thailand has been Vietnam’s 13th largest investor since 1988 with total investments exceeding $14.7 billion.

Thai investors primarily focus on manufacturing, putting 74% of their money in the sector.

Source: e.vnexpress